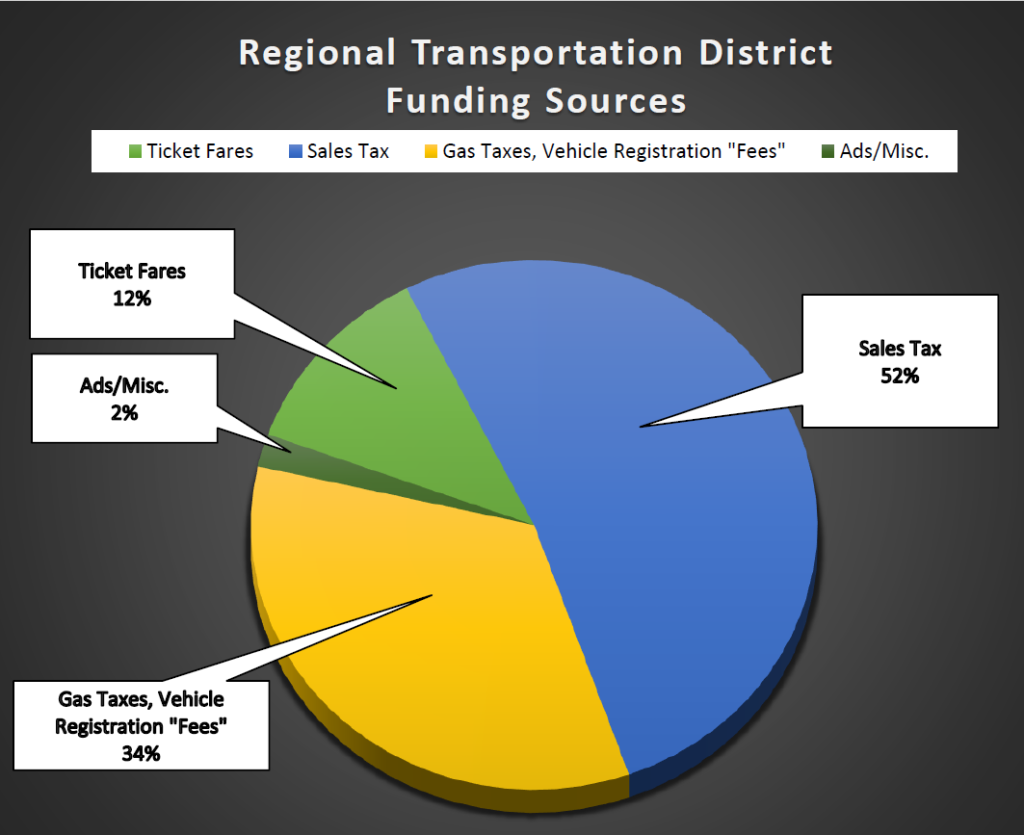

RTD is mainly funded by sales tax from a variety of sources. Passenger fares cover about 15% of the cost.

RTD is under a temporary waiver from the Taxpayer’s Bill of Rights (TABOR) tax revenue limits due to Referendum A passed in 1999. The measure authorized debt to finance the southeast and southwest rail line which were completed in July 2000. Referendum A allowed RTD to keep over-collected taxes until the debt was paid off but no later than December 31, 2026. The debt is scheduled to be paid off in 2024 and over-collected sales taxes will need to be either not overcharged in the first place or refunded to taxpayers.

In 2022, the RTD Board created a TABOR ad hoc committee which continued to meet in 2023. The committee’s agendas focus on temporarily or permanently eliminating the TABOR revenue limits.

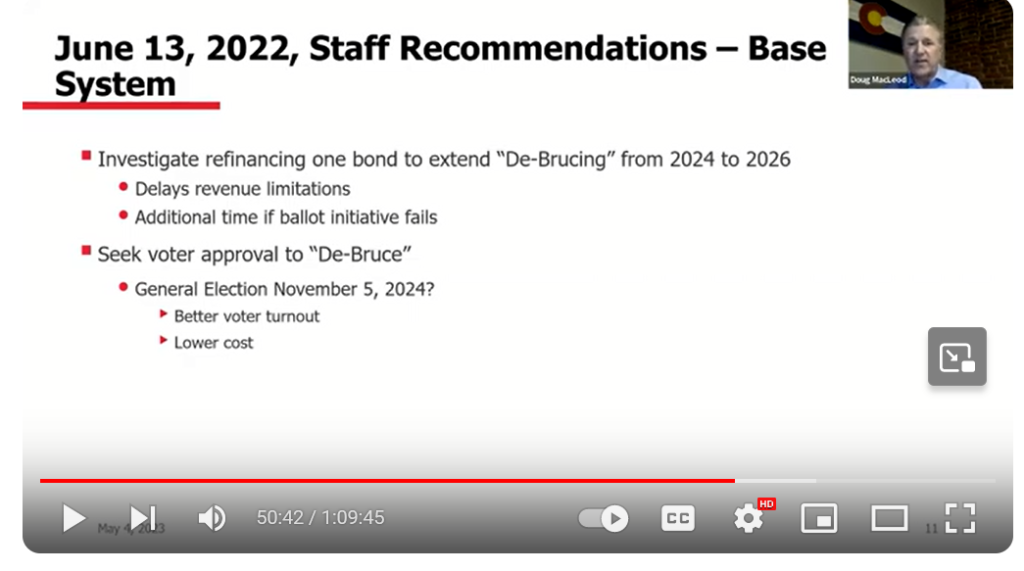

The Board of Directors is even considering refinancing a $5,000 bond just so they can extend the TABOR waiver through 2026. Refinancing the bond would be costly. It would be done for no other reason than to evade TABOR limits for a longer period of time. RTD’s legal counsel wisely advises the TABOR Ad Hoc Committee Members they may be at risk.

Video below bookmarked at that point in the discussion.

Staff recommendations presented to the board are shown below. The Board Directors are responsible for making the decision to refinance a very small bond to evade TABOR limits for potentially a couple more years or put an issue on the ballot in 2024.

Regional Transportation District Makeup

RTD is an elected board with (15) directors. The district includes 59% of Colorado’s population and covers Boulder, Broomfield, Denver, Jefferson counties, parts of Adams, Arapahoe and Douglas Counties, and a small portion of Weld County. Eight board director positions are on the 2024 ballot.

RTD fare revenue has never come close to covering operational costs. Fares cover only 15% of the district’s budget and that has been rapidly dropping as shown on the chart below – click on image to expand.

The remainder of the service is subsidized by sales tax, 0.6% collected for the bus base system and an additional 0.4% sales tax collected for the rail lines named FasTracks.

RTD collects the sales tax on most everyday products, e.g. clothing, some groceries for home consumption and all food for immediate consumption, home improvement supplies, automobiles, appliances, marijuana, and long list of other consumer categories. Ten years ago, the RTD Board of Directors approved a policy to collect sales tax on additional products without voter approval. Their intent was to increase revenue because the district’s revenue goals were falling short.

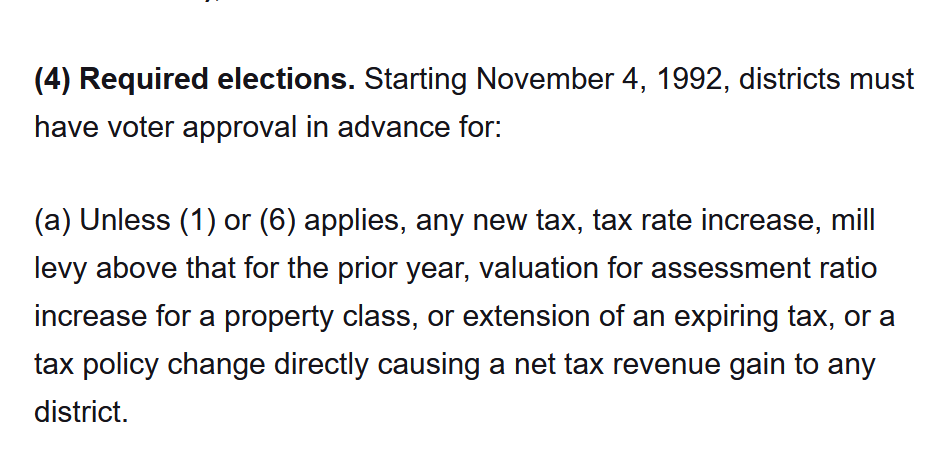

That policy change and additional tax collection led to a court challenge by the TABOR Foundation. The court eventually ruled that collecting millions more in revenue without voter consent was acceptable. The tax increase was “de minimis” and not substantial enough to have triggered a ballot issue requiring voter approval.

TABOR is quite clear on required elections, the court made a faulty ruling.

Taxpayer’s Bill of Rights (TABOR) Article X, Section 20

paragraph 4 – Required elections

In light of a potential Front Ranger Passenger Rail, run by government bodies, this increases the chance of RTD being interwoven into the policy making decision about what if anything should go on the 2024 ballot.