The Colorado State Legislature and local governments have exasperated the property tax problem and complexity over the last four years. Actually, it goes back far more years than just the last four.

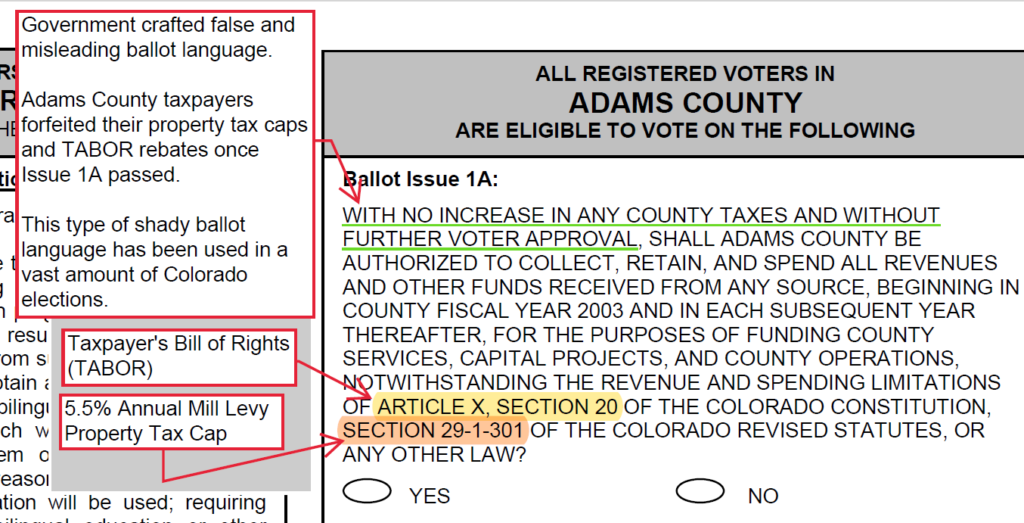

The first problem created by local governments was slyly persuading and misleading voters to give up property tax caps, many of those waivers occurred soon after TABOR was passed by voters in 1992. This type of ballot issue has been nicknamed a “deTABOR”.

Many voters only learned later that they had forfeited TABOR taxpayer protections and their loss of moderate government revenue caps extended far beyond what the tax hike sales pitch informed them.

Some counties, including Jefferson, Weld, Arapahoe, and others have not forfeited their tax caps.

El Paso County Commissioners defended TABOR in this letter to Governor Polis – clearly emphasizing that property owners benefit.

(click text box to expand)

Ballot Language Deception

Here’s just one example, out of many, in illustrating the deceptive local government ballot language used to sway voters to forfeit tax caps over the last two dozen years.

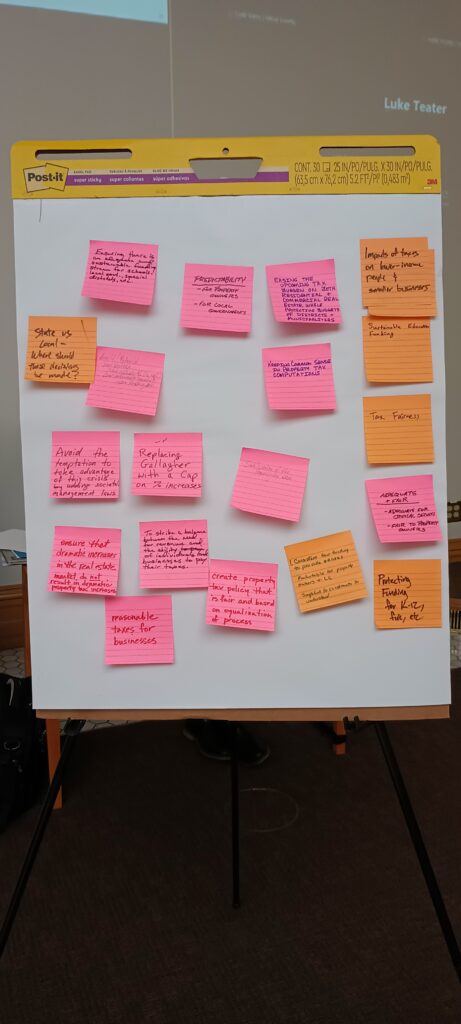

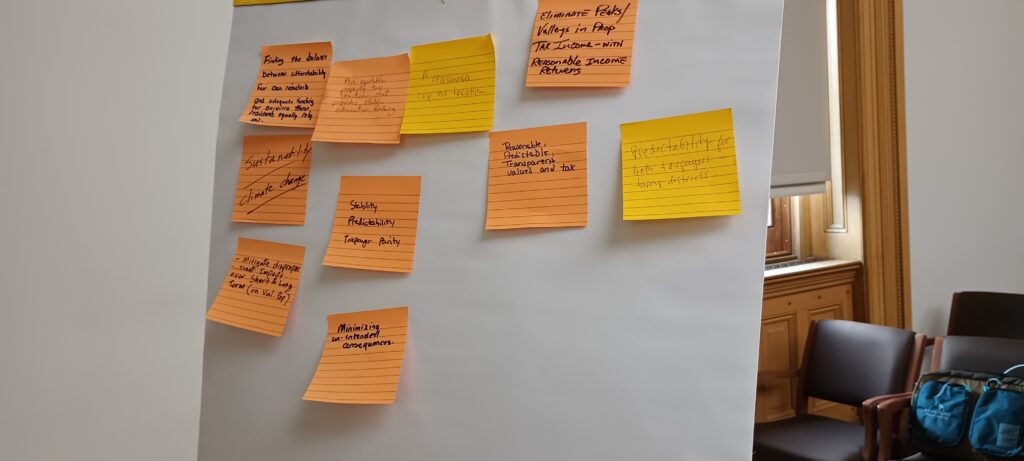

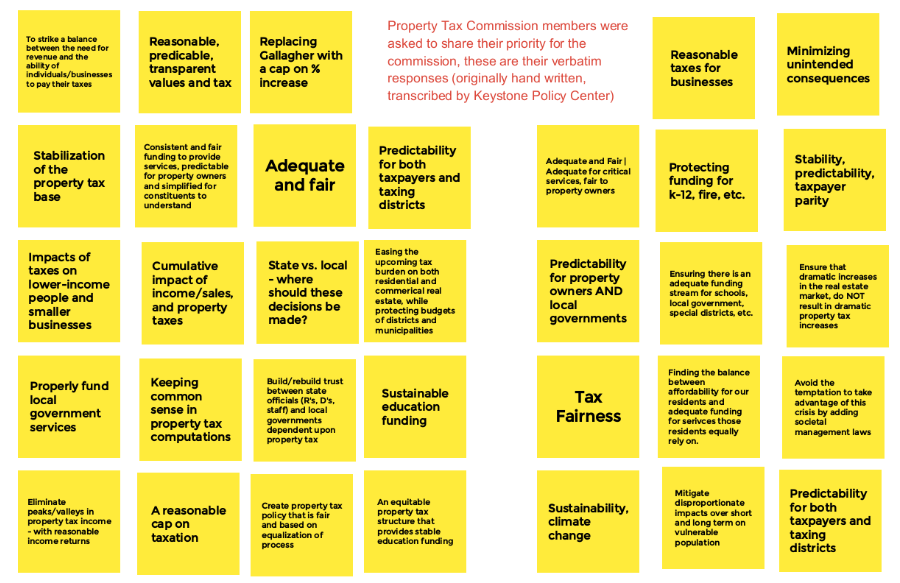

The 19-member task force is was created from the 2023 Special Session. The members are to present recommendations by March 15, 2024.

Editors note: We already have the solution to unreasonable property tax increases. It’s called the Taxpayer’s Bill of Rights (TABOR). Taxpayer’s Bill of Rights, Article X, Section 20, paragraph 7c limits property tax increases.

Additionally, the 5.5% Annual Mill Levy Cap in Colorado Revised Statutes 29-1-301 also provides property tax caps but a

While we have TABOR in place to remedy the property tax situation, the problem lies in that voters were swayed into giving up their TABOR property tax caps many years ago, along with the 5.5% cap. Those protections could be restored with proper leadership in elected roles and also by citizen petition.

Commission on Property Taxes

The Commission on Property Taxes began meeting December 2023.

The upcoming schedule, meeting materials, and past minutes are here. Click on the pictures below to get to presented topics or other media.

Most recently, the commission met to learn more about California’s Proposition 13 which was passed in 1997.

This short video makes it crystal clear why our Colorado TABOR is the gold standard. The Taxpayer’s Bill of Rights formula protects owners and tenants from devastating property tax spikes while still allowing moderate and sustainable government growth.

Santa Clara Assessor Larry Stone describes lessons learned from California’s Proposition 13. When he offers better alternatives, he’s describing our TABOR.

Previous Meeting Materials (click image to get documents)